More About Deed In Lieu Of Foreclosure

The smart Trick of Deed In Lieu Of Foreclosure That Nobody is Discussing

Table of ContentsExcitement About Deed In Lieu Of ForeclosureThings about Deed In Lieu Of ForeclosureThe Facts About Deed In Lieu Of Foreclosure RevealedThe 25-Second Trick For Deed In Lieu Of Foreclosure

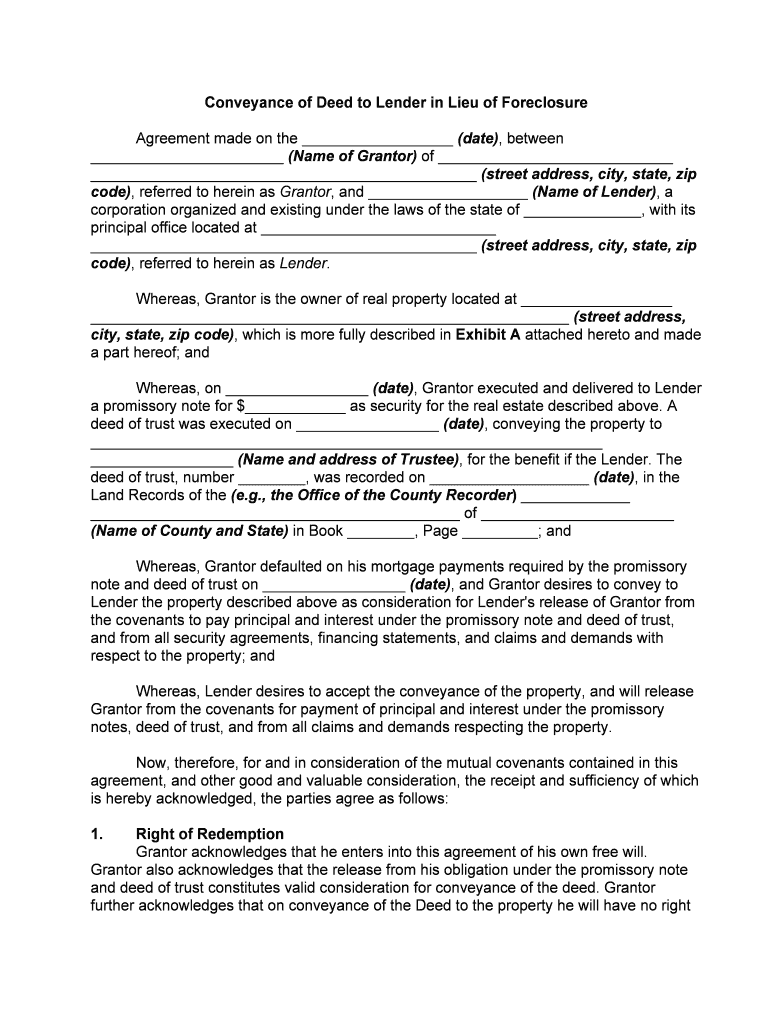

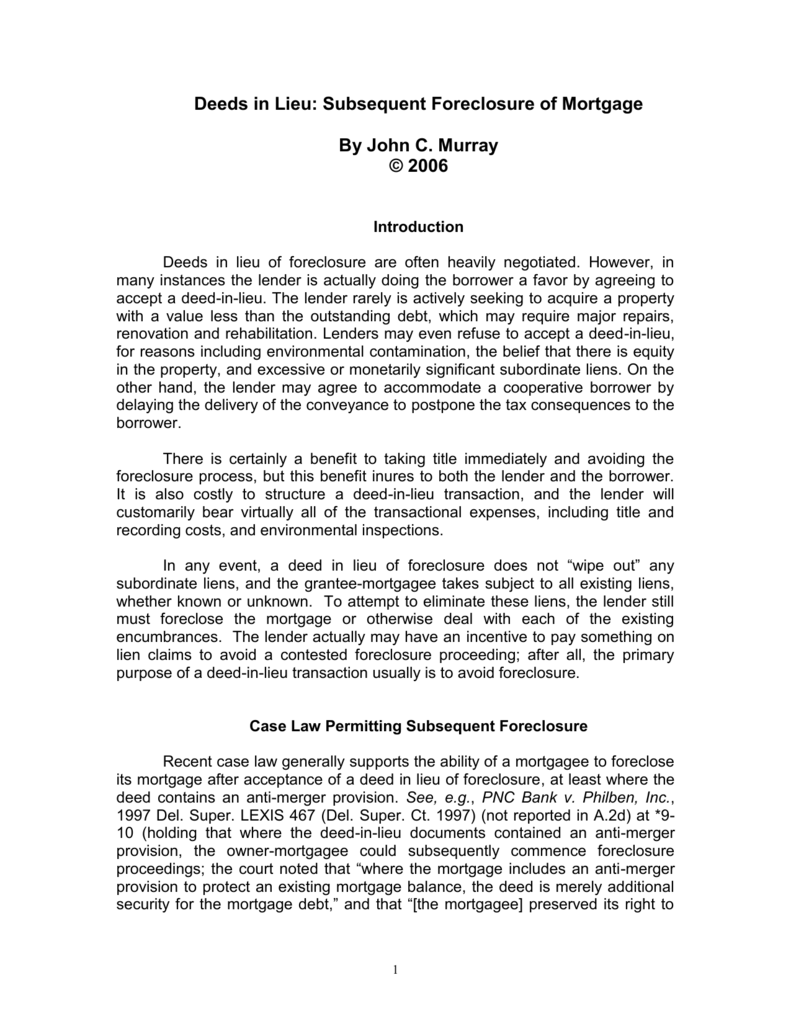

A mortgage release can aid you fix your misbehavior, avoid foreclosure and think about various options to leave the residence. A Mortgage Release is where you, the property owner, voluntarily move the ownership of your home to the proprietor of your home mortgage for a release from your home loan and also repayments.

These consist of instantly vacating the home, remaining in the house for approximately 3 months (no rental fee), or leasing the house (paying market-based rent month-to-month) for up to one year. Furthermore, when you vacate the residence at the agreed-upon date, you are required to leave the homeinside and outsidein excellent condition, without inside and also outside garbage, debris or damages, and also all individual belongings should be eliminated.

A Biased View of Deed In Lieu Of Foreclosure

Inform them you are interested in a Mortgage Release and also you desire to see if you certify. Your mortgage business wants to help you stay clear of repossession and also, in many situations, will be eager to work with you.

Lucy and Jude have an issue. Lucy lately lost her job as well as the family can no more keep up on their home loan browse this site settlements. Making matters worse, they bought throughout the property bubble as well as their home mortgage is underwater, which suggests that the exceptional balance on a house loan is higher than its present reasonable market price.

Despite the fact that the financial institution is ready to accept a short sale where the home is marketed for less then the debt on the funding, no buyers are biting. The bank has actually sent out the needed notification to begin foreclosure procedures where a court will manage the sale of go to this site the home to settle the funding (Deed in Lieu of Foreclosure).

The 20-Second Trick For Deed In Lieu Of Foreclosure

The pair, however, can attempt to convince their lending institution to take an action in lieu of repossession. An action in lieu of foreclosure is merely a deed that a failing customer offers to the lender to prevent foreclosure proceedings. To put it simply, Jude and Lucy will certainly deed possession of their home to the financial institution to satisfy the mortgage.

Note that our discussion concerning warranties to this factor thinks that there is a single warranty in placehistorically called a "poor boy" guarantyand therefore that the loan is likely an irreversible car loan (without future funding for building or remodellings) in contrast to a building loan, which would typically entail delivery of added guaranties such as a conclusion warranty as well as a lug guaranty.

Deed In Lieu Of Foreclosure Fundamentals Explained

We likewise keep in mind that the carry guaranty may consider distribution of an act in lieuin fact, numerous bring warranties are bargained to attend to such a scenario. An act instead avoids the expenses of a foreclosure proceedingin a circumstance in which repossession is a likely "various other" end result. Unlike a repossession case, an act instead provides certainty that the transfer will certainly occurthereby avoiding all manner of delay tactics - and, depending upon the jurisdiction, it can likewise dramatically "conserve" on time when compared to the moment what would certainly been used up performing a repossession action.

In this respect, an act instead might be much less disruptive to the residential or commercial property and the renters as it allows the lender to rapidly take control of (and support or optimize procedures at, or the resale worth of) the residential or commercial property. An action instead might enable a consumer to stay clear of the unfavorable publicity connected with a repossession case and also preserve its credibility with its lender as well as within the "neighborhood".